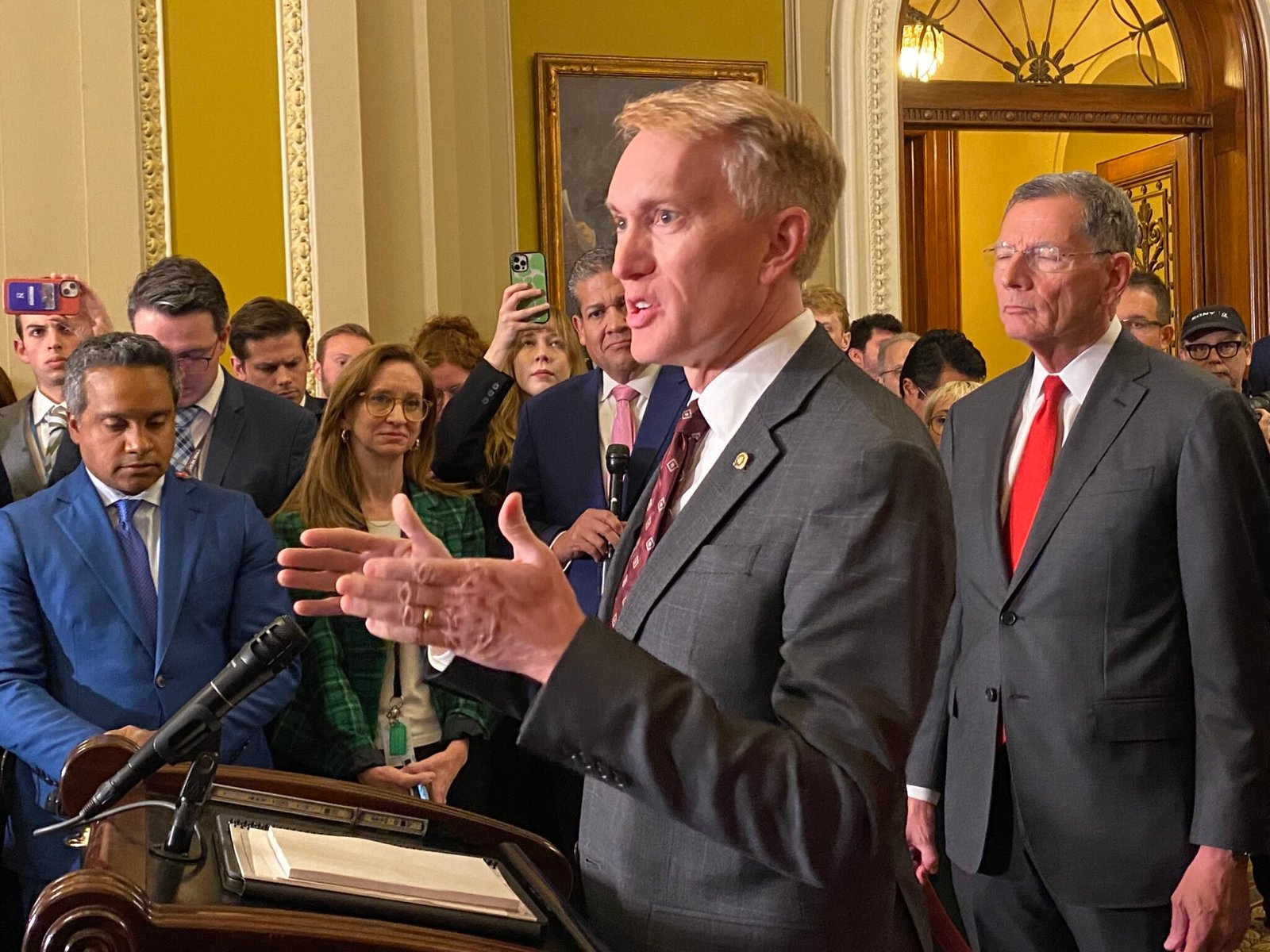

Oklahoma City, OK – Oklahoma’s Republican members of Congress, Senator James Lankford and Representative Kevin Hern, have actively advocated for the tax advantages embedded in the GOP’s “One Big Beautiful Bill” during the August recess. Both were instrumental in shaping the bill’s tax provisions, emphasizing how it safeguards taxpayers from significant rate hikes and ensures lasting economic benefits for individuals and businesses.

With a focus on extending the tax relief initially provided by President Trump’s 2017 tax cuts, the legislation aims to stabilize the tax landscape and provide certainty for American families and companies alike.

Preserving Tax Cuts and Preventing Tax Increases

Representative Kevin Hern stressed that the bill’s most crucial benefit is preventing an average tax increase of 22% across the board, a rise taxpayers would otherwise face without this legislation.

“The American people, Oklahomans, people in the 1st District, would have seen their taxes increase on average 22% across the board. You won’t see that now,” said Hern.

Hern further explained the importance of federal restraint in tax policy: “Sometimes the federal government needs to do no harm, and this is doing no harm.” The bill’s tax portion was intricately developed with direct input from Oklahoma’s delegation.

Key Features of the Tax Provisions

The bill enshrines several critical tax policies for individuals and businesses:

- Income tax rates made permanent, with the highest rate remaining at 37%.

- Permanent increase in standard deductions.

- No tax on tips and overtime work guaranteed through the congressional term.

- Permanent extension of the increased child tax credit, a significant relief for families.

- Qualified business income deduction fixed permanently at 20%.

- 100% bonus depreciation reinstated and made permanent to benefit businesses.

- Permanent expensing for domestic research and experimentation to incentivize innovation.

- Modifications to adjusted financial statement income calculations for taxpayers with oil and gas operations.

Supporting Working Families and Businesses

Senator James Lankford highlighted provisions aiming to support families and businesses, including additional incentives for child care:

“We extended the child tax credit during this time. We gave an extra tax benefit to companies that want to do child care on-site to be able to improve the availability of child care for businesses,” Lankford said.

These measures respond to constituents’ concerns about balancing work and family needs, while fostering economic growth.

Community Feedback and Outlook

Lankford shared that feedback from Oklahomans has been largely positive, reflecting satisfaction with the changes and their expected impact.

“People are very pleased with the tax changes and what actually that means for their individuals, for their businesses, and what that means for nonprofits,” he said.

This sentiment indicates the bill’s potential to stabilize the financial outlook for Oklahomans and support a broad spectrum of economic actors.

For more detailed coverage on these developments, see the report by Griffin Media’s Alex Cameron, an experienced Washington Bureau Chief, here.

Looking Ahead: Implications for Oklahoma and Beyond

The permanence of these tax provisions creates a more predictable fiscal environment, encouraging investment and planning for future growth. With Oklahoma’s leaders actively shaping the bill, constituents can expect continued advocacy for economic policies that protect individual taxpayers, support businesses, and foster workforce development.

- Tax rates remain predictable and stable, avoiding sudden hikes.

- Families benefit from permanent child tax credits and protections on tips and overtime.

- Businesses gain incentives for capital investments, research, and child care innovations.

What do you think about the GOP’s One Big Beautiful Bill and its tax benefits? Have these changes impacted you or your business in Oklahoma? Share your thoughts in the comments below!