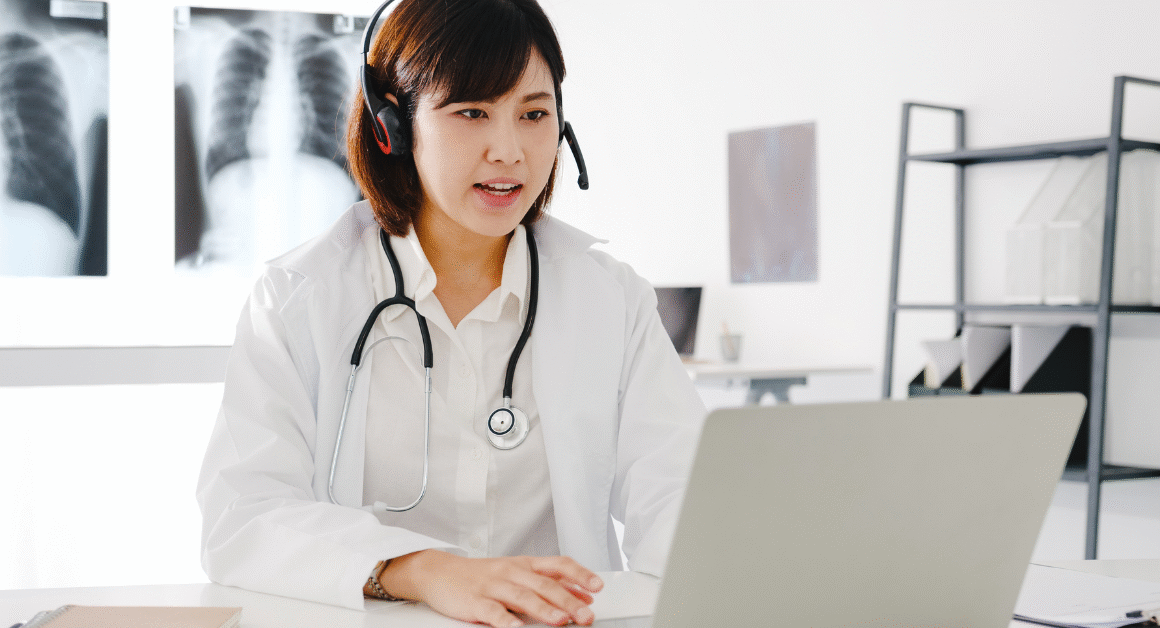

Planning for health care costs in retirement is becoming increasingly critical as retirees face fluctuating premiums, policy changes, and varying expenses depending on multiple factors such as retirement age and location.

Breakdown of Health Care Savings Needs for Retirees

The $388,000 total savings requirement includes coverage under Medicare Parts A and B, Medigap Plan G, and Medicare Part D, with the costs divided between a man and a woman reflecting their differing life expectancies:

- $185,000 needed by a healthy 65-year-old man estimated to live to 88 years old.

- $203,000 required by a healthy 65-year-old woman expected to live to 90 years old.

While this sum has decreased by $7,000 compared to 2024, it still reflects a $17,000 increase since 2022. Recent changes influencing these costs include a 2% rise in Medicare Part B premiums, a 2.5% drop in projected future inflation, and a 1.8% decrease in Medicare Part D premiums.

For retirees opting for Medicare Advantage (Part C) plus Part D prescription coverage, the savings needed are significantly lower, at $183,000 for a couple. This includes:

- $87,000 for a man living to age 88.

- $96,000 for a woman living to age 90.

This reflects a slight increase of $1,000 from last year but is $12,000 less than the 2022 figure. Cost shifts here include a 2.5% increase in Medicare Part B premiums, a 1.2% rise in out-of-pocket expenses, and a 2.6% decrease in projected inflation.

Factors Influencing Retirement Health Care Costs

Milliman experts emphasize that numerous variables affect the budgeting required for post-retirement health care. These factors include:

- Age at retirement: Retiring at 60 can result in paying 56% more for traditional Medicare coverage and 90% more for Medicare Advantage than retiring at 65.

- State of residence: Seniors in Florida face the highest costs for Medicare Parts A, B, D, and Medigap Plan G, while New Mexico remains the least expensive. For Medicare Advantage and Part D, Maryland, Massachusetts, Minnesota, and New York are the priciest states, with Florida and Nevada being more affordable.

- Health status and lifespan: Longer life expectancy and poorer health can drive up premiums and out-of-pocket expenses.

- Regulatory changes: The Inflation Reduction Act of 2022 has also influenced prescription drug pricing by allowing Medicare to negotiate prices.

“Many factors can impact the amount of savings retirees need for their healthcare, including when they retire, where they live, health status and the type of coverage they have,” stated Robert Schmidt, co-author of the Retiree Health Cost Index and principal and consulting actuary at Milliman. “Understanding what these costs are and how they can change year-to-year is key for both consumers and employers.”

Potential Impact of Cost Variations and Expert Recommendations

Milliman notes that while their projections are based on in-depth research, even small variations in spending trends can significantly impact retirees’ overall costs. For example:

- A 1% annual increase in health care spending could raise total retirement health costs by approximately 15%.

- A 1% annual decrease in spending could reduce overall costs by about 13%.

In alignment, analysis by T. Rowe Price found that Medicare premiums constitute the largest health care expense for most seniors, frequently deducted directly from Social Security benefits. They advise both retirees and financial advisers to view health care as a part of the monthly budget rather than a one-time lifetime cost.

For more detailed information on these findings, visit the original report at PlanAdviser.

What This Means for Retirees Planning Ahead

Retirement planning experts suggest that individuals should start early in evaluating their expected health care costs and consider factors such as the type of Medicare coverage, location, and their planned retirement age. This approach can help ensure that their savings are sufficient to cover future medical needs without unexpected shortfalls.

Key takeaways for retirees include:

- Assess your anticipated retirement age and how it affects health coverage costs.

- Consider Medicare Advantage as a potential cost-saving alternative to traditional Medicare packages.

- Evaluate living states, as geographic differences can have a major impact on health care expenses.

- Factor in longevity and health status when planning savings for medical costs.

What do you think about this healthcare savings projection? Have you started planning your retirement healthcare expenses? Share your thoughts in the comments below!