Health insurance is a crucial part of employee benefits in the United States. However, costs are rising, and new reports predict that employee health plan premiums will increase by 6 to 7 percent in 2026. This rise is mainly due to the growing expenses of specialty drugs and greater demand for behavioral health services. Understanding why these changes are happening helps workers prepare for the future.

The cost increase is significant enough to impact many employees and employers across the country. Specialty medications, which treat complex conditions like cancer and rare diseases, have high price tags. Meanwhile, mental health and behavioral health needs have grown sharply, especially since the Covid-19 pandemic. These factors combined are driving up the overall costs of health plans.

Why Are Specialty Drugs Driving Up Health Plan Costs?

Specialty drugs represent a small share of prescriptions but account for a large portion of drug spending. These medicines treat serious conditions such as cancer, multiple sclerosis, and rare genetic disorders. According to the Kaiser Family Foundation, specialty drugs are expected to be the fastest-growing part of drug spending in the coming years (KFF.org).

The high cost of developing these drugs and the complexity of treatments result in higher prices. Employers who provide health insurance must cover these expenses, leading to increased premiums for employees. In fact, larger employers are now paying more attention to managing specialty drug costs through various strategies, including better benefit designs and negotiating prices.

The Rising Demand for Behavioral Health Services

Behavioral health, which includes mental health and substance abuse treatment, has seen increased usage in recent years. The pandemic caused many people to experience stress, anxiety, and depression, leading to greater demand for counseling and other mental health services. As a result, insurance plans are covering more behavioral health treatments, which raises costs for employers’ health plans (Commonwealth Fund).

This trend is expected to continue, pushing health plan premiums higher. Employers are encouraged to invest in wellness programs and mental health support to reduce long-term costs and improve employee wellbeing. Providing adequate coverage for behavioral health is an important part of supporting a healthy workforce, but it comes at a price.

What Does This Mean for U.S. Employees?

For employees, the premium increase means higher out-of-pocket costs for health insurance. Depending on the employer’s plan, workers might see their monthly payments go up noticeably in 2026. This can be a challenge, especially for younger employees or those with lower incomes.

Experts recommend reviewing health plans carefully during enrollment periods to choose the best coverage options. Some employers may offer different plans with varying premiums and benefits, so it’s a good idea to compare options. Employees should also take advantage of company wellness programs and look for ways to stay healthy to avoid extra medical costs.

How Employers Are Responding

Employers are looking for ways to manage these rising costs. Many are adopting strategies like promoting the use of generic drugs instead of more expensive specialty drugs when possible. Others are partnering with pharmacy benefit managers to get better prices on medications.

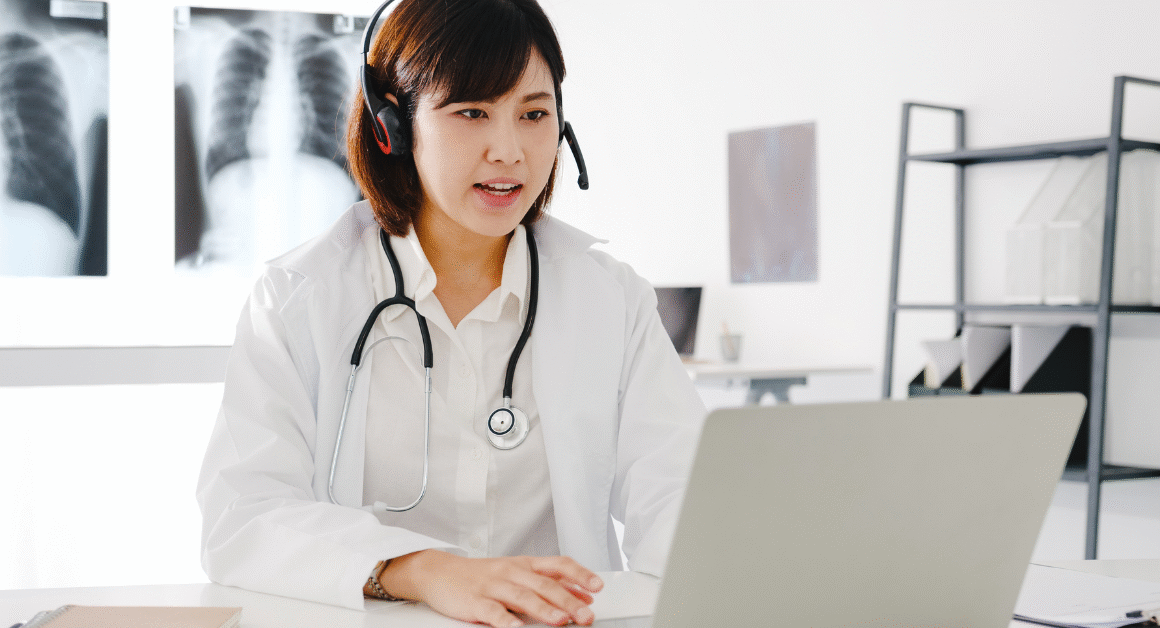

Some companies are also expanding telehealth services for behavioral health, making it easier and less expensive for employees to get mental health support. These approaches aim to keep premiums as affordable as possible while still offering quality benefits.

Looking Ahead: What Can Be Done?

The increase in premiums highlights the need for policy solutions to control drug prices and improve mental health care access. Lawmakers and health experts are discussing options such as allowing Medicare to negotiate drug prices and expanding mental health services in community settings.

Until then, both employers and employees need to stay informed about changes in health plans and costs. Keeping a close eye on emerging trends can help American workers navigate the evolving health insurance landscape more confidently.