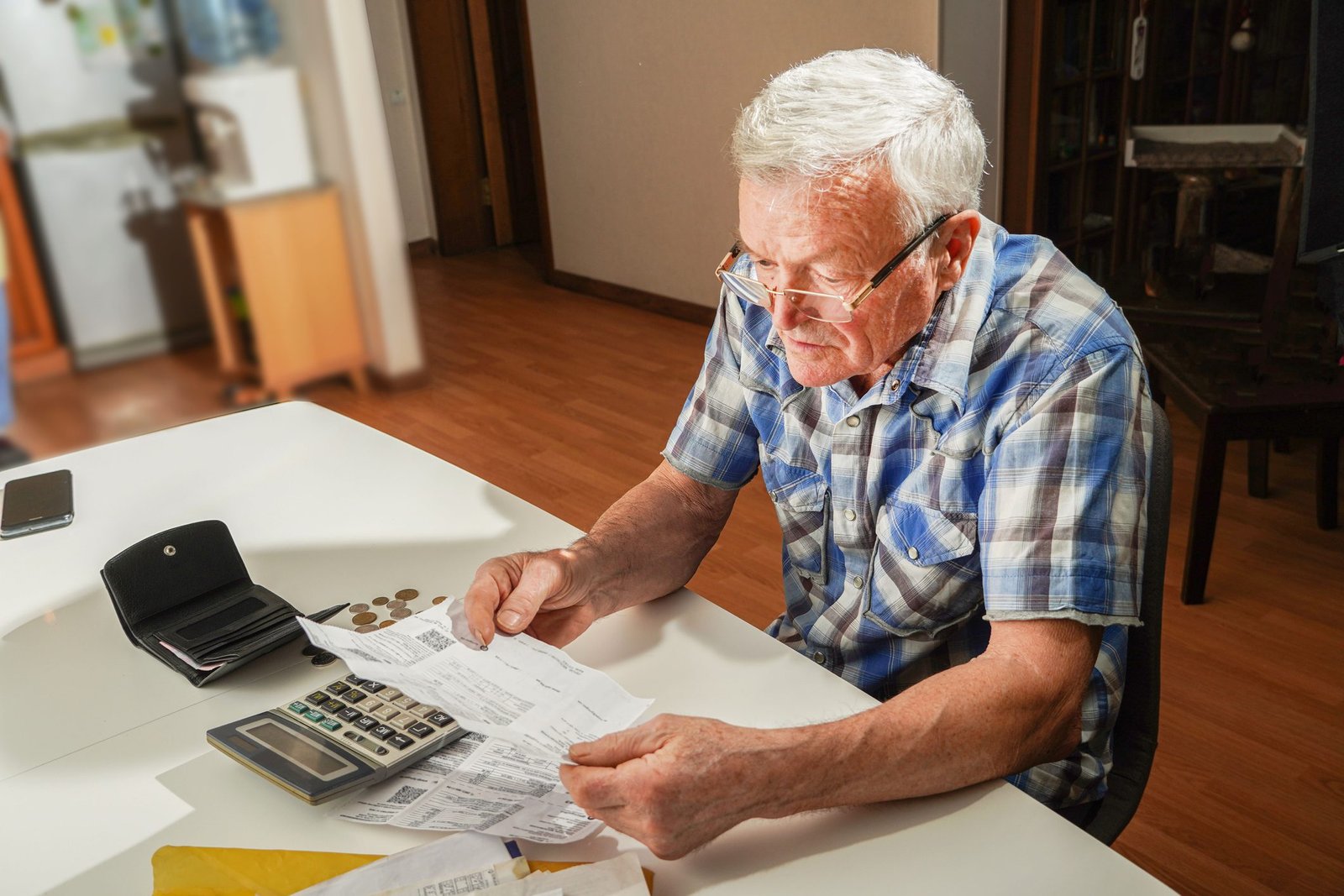

Filing taxes can be confusing, especially for seniors. If you are over 65 and living in West Virginia, you might be eligible for a special tax benefit called the Extra Standard Deduction. This extra deduction can lower the amount of taxable income, which means you could pay less in state taxes. Understanding how it works can help you or your loved ones save money during tax season.

In this article, we will explain what the West Virginia Extra Standard Deduction for seniors over 65 is, who qualifies for it, and how to claim it on your tax return. We will also share some helpful resources to guide you through the process so you feel confident when filing your taxes.

What Is the West Virginia Extra Standard Deduction?

The Extra Standard Deduction in West Virginia is an additional tax deduction that seniors aged 65 or older can claim on their state income tax returns. It is meant to reduce the taxable income for older adults who often have fixed or limited incomes. This deduction is separate from the regular standard deduction that all taxpayers can use.

By taking this extra deduction, seniors can lower the amount of income that is taxed by the state, which may reduce their overall tax bill. It helps make living on a retirement income a bit easier by allowing seniors to keep more of their money.

Who Qualifies for the Extra Standard Deduction?

To qualify for the West Virginia Extra Standard Deduction for seniors, you must meet the following conditions:

- Be 65 years of age or older by the end of the tax year.

- Be a resident of West Virginia.

- File a West Virginia state income tax return using the standard deduction.

If you meet these requirements, you are eligible to claim the extra deduction amount when you file your state taxes.

How Much Is the Extra Standard Deduction?

The amount of the extra standard deduction is set by the West Virginia State Tax Department and can change each year. For example, in recent years, seniors over 65 have been able to claim an additional deduction of approximately $2,000 to $4,000 on top of the basic standard deduction.

To find the current deduction amount, you can visit the official West Virginia State Tax Department website, which provides updated guides and forms: West Virginia State Tax Department.

How to Claim the Extra Standard Deduction on Your Tax Return

Claiming the extra standard deduction is simple if you use the West Virginia state tax form WV-40 (the individual income tax return form). When filling out the form, you will choose to take the standard deduction, and then enter the extra amount for seniors.

The instructions for the WV-40 form clearly explain where to put the extra deduction amount. If you are using tax software or working with a tax professional, just be sure to mention your age to ensure the extra deduction is applied correctly.

Additional Tax Benefits for West Virginia Seniors

Besides the extra standard deduction, seniors in West Virginia may qualify for other tax relief programs. For example, the state offers property tax relief programs to help retirees on fixed incomes. Another option is the Social Security exemption, which may exclude some Social Security income from state taxes.

To learn more about these benefits, you can visit the West Virginia Tax Relief Programs page or consult the West Virginia Senior Services resources.

Why This Matters for Younger Generations

Even if you are not a senior yet, understanding these tax benefits can help you plan for the future. Parents or older relatives might qualify for deductions that can ease their financial burden, and knowing these facts can help you support them better. It’s also useful knowledge as you start thinking about your own retirement planning.

Whether you’re filing taxes yourself or helping family members with theirs, knowing about the West Virginia Extra Standard Deduction for seniors is a smart step toward making tax time less stressful and more affordable.

References

West Virginia State Tax Department