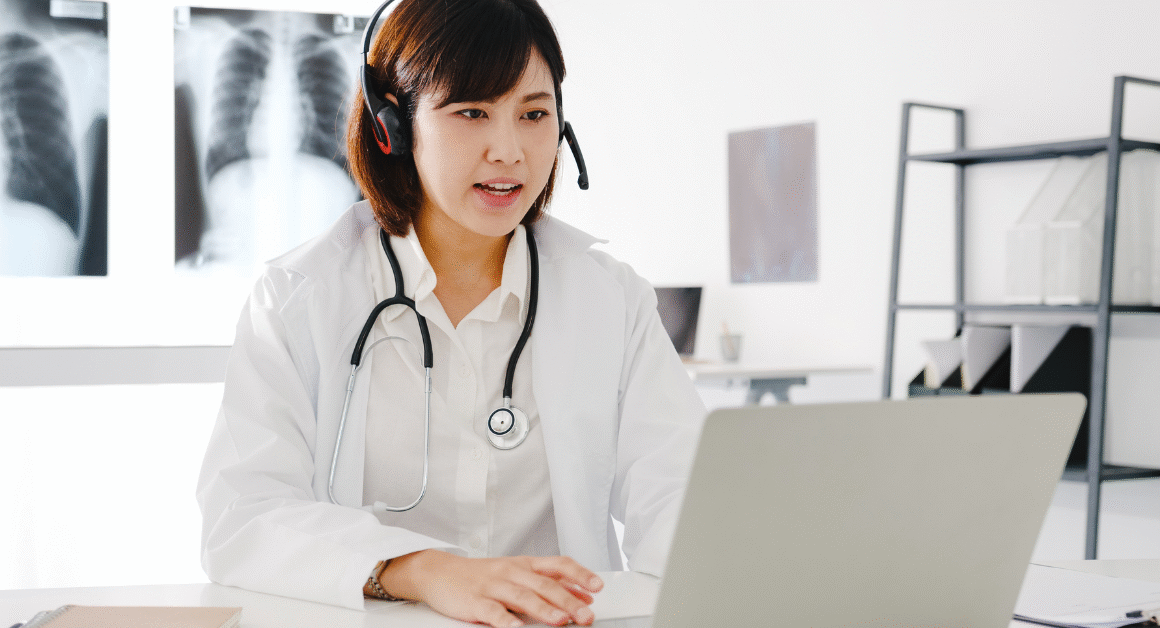

Healthcare costs are a growing concern for many people in the United States. With premiums rising every year, finding affordable health insurance is becoming more challenging, especially for younger and healthy individuals who want to protect themselves without paying high monthly fees. To address this, the Centers for Medicare & Medicaid Services (CMS) has announced an expansion of access to catastrophic health insurance plans for the 2026 plan year.

This move aims to offer more budget-friendly options for people looking for essential health coverage. If you are a young adult or someone who qualifies for a catastrophic health plan, this could be good news as it may lower your health insurance costs while still providing important protection against major medical expenses.

What Are Catastrophic Health Insurance Plans?

Catastrophic health insurance plans are designed for young, healthy people who don’t expect to need regular medical care but want protection in case of a serious health problem or accident. These plans usually have low monthly premiums but high deductibles. This means you pay less each month but will pay more out-of-pocket if you need care.

According to healthcare.gov, catastrophic plans cover three primary care visits per year before you meet your deductible, as well as essential health benefits after the deductible is paid. They offer protection against very high costs if a major health emergency occurs, making them a safety net for unexpected events.

Why Is CMS Expanding Access to These Plans in 2026?

Premiums for standard health insurance plans have been climbing, making it hard for many people to afford coverage. Younger adults and low-income earners in particular struggle with the rising costs. CMS noticed this issue and decided to expand the availability of catastrophic plans as a more affordable alternative.

This expansion means more people will be eligible to buy catastrophic plans nationwide, not just in certain states or under strict conditions. The hope is that by providing these lower-cost options, more Americans will get covered and avoid being uninsured due to high expenses. CMS explains this update on their official announcement page here.

Who Can Benefit from Catastrophic Health Plans?

Originally, catastrophic plans were available only to people under 30 or those with a hardship exemption. Now, with the expansion, there will be more relaxed criteria allowing a bigger group of people to qualify. This includes some older adults who previously did not meet the age limit but still want lower premiums.

Young adults who are starting their careers or those who only need emergency coverage might find catastrophic plans a smart choice. Instead of spending a lot on monthly premiums, they can pay less while still having essential health benefits if something unexpected happens.

How Does This Impact Health Insurance Costs and Coverage?

By expanding access, CMS hopes to reduce the average cost of health insurance for many Americans. Lower premiums can encourage more people to get insured, which helps spread risks among a larger group. This balance is critical for keeping healthcare affordable even as other plans become more expensive.

However, it’s important to understand that catastrophic plans are not for everyone. Because of the higher deductible, you may pay more out-of-pocket in case of illness or injury before the insurance starts to cover costs. So, if you expect regular medical needs, a different plan might be better.

What Should Younger Americans Know About Catastrophic Plans?

If you are under 30 or qualify for the hardship exemption, this news from CMS means you will have easier access to a low-premium option in 2026. It can be a suitable health insurance plan if you are healthy and want to prepare for emergencies without the burden of high monthly payments.

As Consumer Reports suggests, it’s crucial to compare plans carefully and evaluate what each covers before choosing. A catastrophic plan protects against sky-high costs from serious conditions but does not cover many routine health expenses upfront.

Conclusion

The expansion of catastrophic health insurance plans by CMS for the 2026 plan year is a positive development in the face of rising health insurance premiums. It offers a chance for younger and financially vulnerable individuals to access affordable health coverage tailored to their needs. Before making a choice, consider your health situation, financial ability, and coverage requirements to find the best insurance option.