Medicare beneficiaries and their families should pay close attention to an important update regarding Part B premiums. These premiums can significantly impact healthcare costs, making it vital to stay informed. The upcoming changes could be some of the most significant adjustments this year, affecting how much you pay for medical coverage.

Understanding these adjustments early helps you prepare and avoid surprises in your healthcare budget. Whether you are new to Medicare or have been enrolled for some time, knowing about the expected Part B premium changes can empower you to make smarter financial decisions.

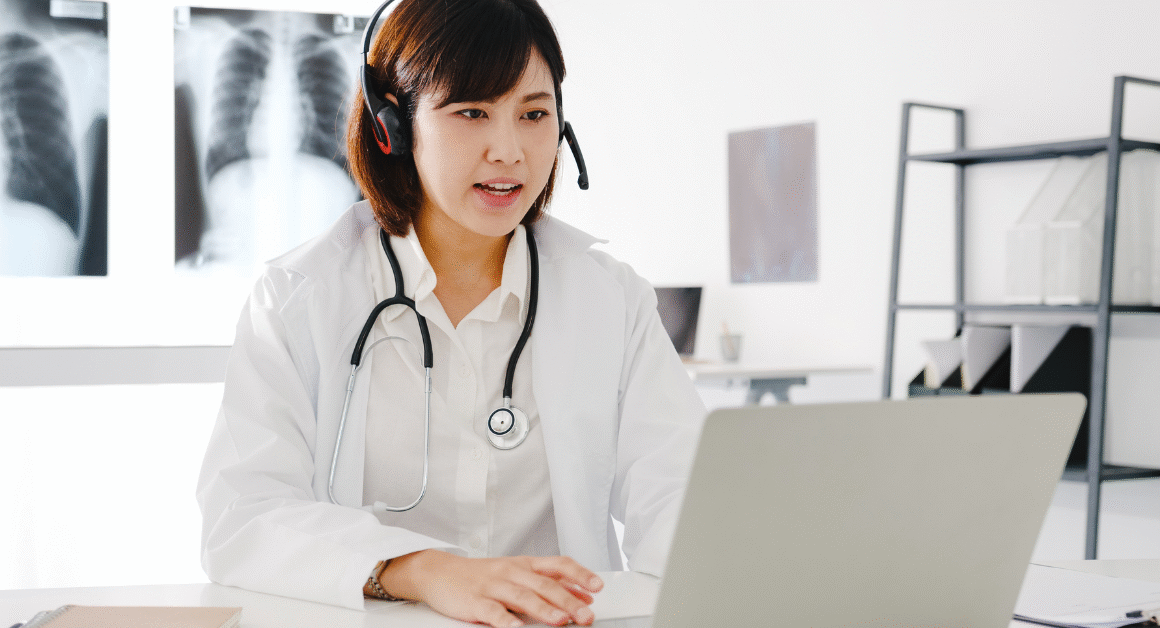

What Is Medicare Part B and Why Does Its Premium Matter?

Medicare Part B covers outpatient care, doctor visits, preventive services, and some home health care. Unlike Part A, which generally has no cost for most people, Part B requires a monthly premium. This premium is based on income, and it directly affects your out-of-pocket healthcare expenses.

Because Part B covers essential medical services, changes to the premium impact millions of Americans. Even small increases can add up, especially for seniors and individuals on a fixed income.

What Are the Expected Part B Premium Adjustments for 2024?

Officials predict that Part B premiums will rise by nearly 15% in 2024, which could be the largest increase in over a decade. According to the Centers for Medicare & Medicaid Services (CMS), the standard premium will increase from $170.10 in 2023 to about $194.70 in 2024.

This adjustment results from higher healthcare inflation and increased costs in medical care services and supplies. The hike is designed to cover these growing expenses but will require beneficiaries to reevaluate their budget planning carefully.

How Will These Changes Affect You Financially?

If you are already paying for Part B, a premium hike means spending more each month on your healthcare coverage. For some, this increase could impact their ability to afford other necessary expenses like medications or daily living needs.

You should also consider additional costs such as copayments, coinsurance, and deductibles, which can add up quickly alongside premium hikes. Being proactive in understanding your total healthcare costs helps prevent last-minute financial stress.

What Can You Do to Prepare for the Premium Increase?

First, review your current healthcare budget and see where you can adjust expenses. It’s a good idea to explore supplemental insurance plans, also known as Medigap, which might help offset some of the increased costs.

You may also qualify for programs like the Medicare Savings Program, which helps lower-income individuals pay premiums and other Medicare costs. For more details on financial assistance, visit the official Medicare website.

Stay Updated and Informed

Medicare updates like these tend to happen annually, but a nearly 15% increase deserves your immediate attention. Stay current with official announcements from the CMS and trusted news sources to avoid surprises.

For further reading on Medicare changes and to compare plans, the Kaiser Family Foundation offers detailed insights and tools. Using these resources ensures you make the best choices based on the latest information.

Conclusion

The upcoming Medicare Part B premium increase is a critical update that everyone should not ignore. Being aware of the expected changes allows you to manage your healthcare expenses wisely and avoid unpleasant financial shocks.

Take the time now to review your Medicare coverage and budget accordingly. By staying informed and proactive, you can continue to access the medical services you need without unnecessary stress or hardship.